Letter from the Editor

Why this magazine exists: named authors, verifiable data and a commitment to publish methods, sources and corrections for Global South analysis.

Read the full letter →

From tax revolts and FX experiments to water stress, climate migration and the next wave of South–South trade. The Meridian's inaugural issue maps the real economic forces reshaping Africa, Asia and Latin America — with named authors, verifiable data and a commitment to publish methods, sources and corrections.

Why this magazine exists: named authors, verifiable data and a commitment to publish methods, sources and corrections for Global South analysis.

Read the full letter →

Dams, droughts and debt: how water scarcity collides with power, mining and food imports across a thirsty region.

A Finance Bill withdrawn after deadly protests: what it means for debt, taxes and trust in East Africa's anchor economy.

After rate unification and sharp depreciation, can policymakers rebuild credibility before politics erodes the new regime?

When fiscal consolidation meets a young, connected electorate willing to push back in the streets.

A managed float, shrinking parallel premium and the political cost of allowing prices to reset.

Ambitious reconstruction plans meet investor caution and unresolved political risk.

As Mali, Niger and Burkina Faso reconfigure alliances, a different regional order starts to take shape.

Blackouts, bailouts and the politics of opening the grid to independent power producers.

Can a small island keep its role in global capital flows under tighter transparency and tax rules?

Lagos, Nairobi and Kinshasa absorb internal migrants long before any reach European shores.

Data, talent and compute — and the battle to avoid a second wave of digital colonialism.

The new geography of urban thirst — and its implications for power, mining and migration.

Incentives, supply chains and the reality behind the headlines of 'China plus one'.

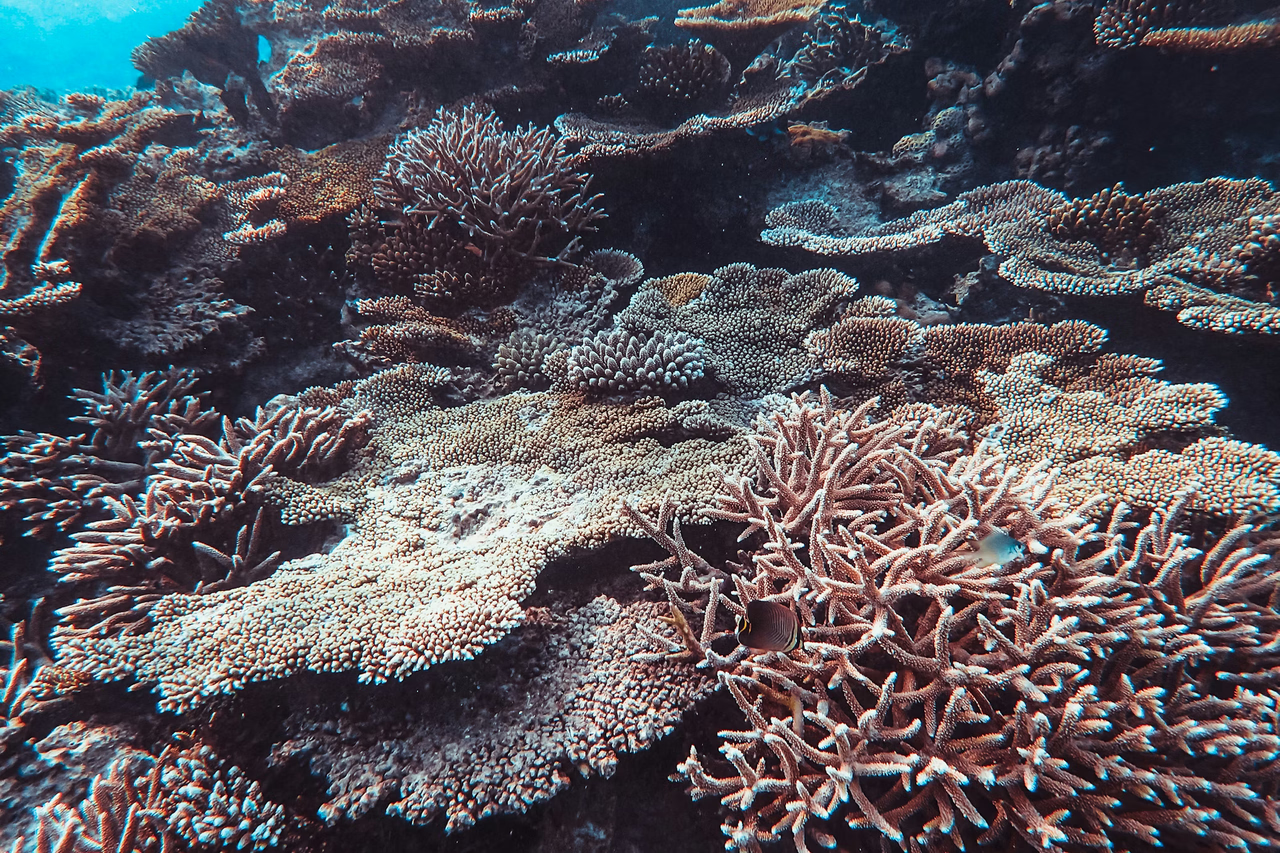

Export bans, EV ambitions and the environmental cost of being indispensable to the green transition.

Karachi, Dhaka and Manila move into a climate zone where work hours and health budgets collide.

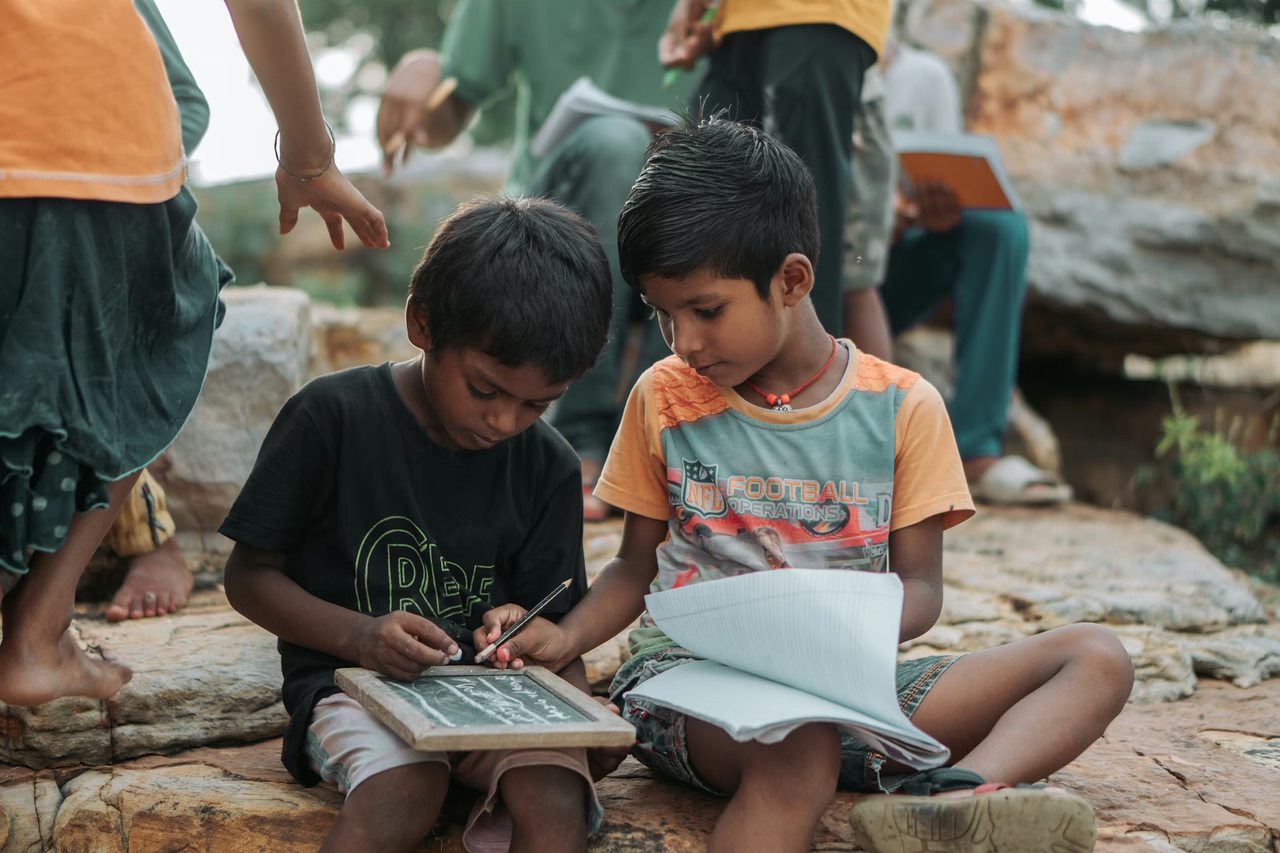

High enrolment but low learning outcomes — and a generation still carrying the scars of lost school time.

What happens when IMF timelines meet electoral cycles and reform fatigue.

A larger programme, energy tariff reforms and the politics of keeping reserves stable.

The wage and trade architecture that keeps food cheap in the North and labour precarious in the South.

Dollarisation-lite, subsidy cuts and the social limits of radical economic experiments.

Can a new model share resource wealth, fund the transition and still keep investors at the table?

Petro's public-health experiment meets the entrenched economics of the cocaine trade.

What happens to local economies if the forest crosses a point of no return?

Markets, social spending and the search for a credible budget rule in a low-growth world.

Are supply chains genuinely relocating, or are old flows being rebadged as 'nearshoring'?

How Saudi Arabia and the UAE are rewriting bailout politics and development finance across the Global South.

Beyond photo-ops: what an alternative financial architecture could realistically look like.

Food, fuel and manufacturing corridors linking developing economies to each other rather than to the North.

Tourism, sea-level rise and great-power competition across three vulnerable island states.

Why the Global South is paying more for calories than ever — and how weak currencies act as a hidden tax.

A broken ladder for a generation — degrees, debt and disappearing formal jobs.